2023 Tax Planning

Dear Valued Client,

Attached is our 2023 Tax Letter which highlights some of the changes that may affect your 2023 Tax Return.

2023 Tax Letter

Please be advised: If you have had significant changes in income or think you may have a large liability, please reach out to us to inquire about a Tax Analysis before December 31, 2023.

Individuals and households affected by the Seawater Intrusion that reside or have a business in Jefferson, Orleans, Plaquemines, and St. Bernard parishes now have until Feb. 15, 2024, to file various individual and business tax returns and make tax payments that were originally due during this period. This includes 2022 individual income tax returns due on Oct. 16, 2023. The IRS noted, however, that because tax payments related to these 2022 returns were due on April 18, 2023, those payments are not eligible for this relief.

Please see below the important due dates that can save you from IRS penalties.

***IMPORTANT DUE DATES TO REMEMBER***

March 15th— 1065(Partnerships) and 1120S(S-Corporations) returns are due. Also, extension to file return late is due.

April 15th— 1040(Personal) Series and 1120(Corporations) returns are due. Also, extension to file 1040’s and 1120 are due.

May 15th— 990(Non-Profit) returns are due. Also, extension to file return late is due.

September 15th— 1120S(S-Corporations) and 1065(Partnerships) returns that filed for extensions are due.

October 15th— 1040(Personal) Series and 1120(Corporations) returns that filed for extensions are due.

November 15th— 990(Non-Profit) returns with extensions are due.

Remember, the extension does not relieve you of penalties and interest associated with tax liabilities. They only relieve you from failure to file penalties and interest. Payments are due on the original due date. If you think you will owe you should make an estimated tax payment before the due date.

The IRS is penalizing businesses for returns that are not filed on time or past the extension deadline. They will abate the penalties one time. After that you must show reasonable cause as to why your return was not filed in a timely manner.

IF YOU REQUIRE AN EXTENSION, YOU MUST CONTACT OUR OFFICE AT LEAST TWO BUSINESS DAYS BEFORE THE EXTENSION DUE DATE IN ORDER TO ENSURE YOUR EXTENSION HAS BEEN FILED AND ACCEPTED BY THE IRS.

We are available to meet with you before year end to make sure you take full advantage of the changes. Please call our office at 504-367-3554 to schedule your appointment soon.

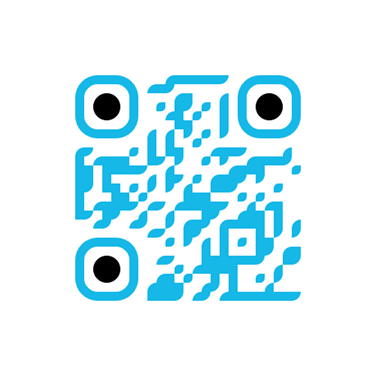

Please also subscribe to our text list to receive important updates and information by scanning the QR code below or text EDK to 833-952-3658.